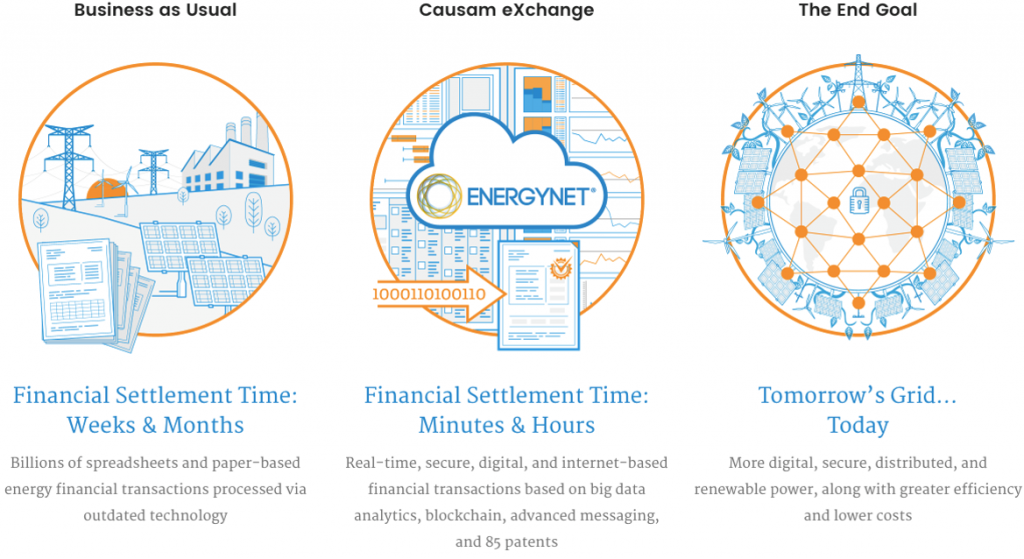

Causam eXchange, a privately-held financial transaction technology company, is offering up to 1,000 U.S. accredited investors an opportunity to purchase equity ownership to bring unprecedented speed, security, and flexibility to billions of energy financial transactions each year. Energy transactions today use obsolete technology. Causam is revolutionizing how power is bought and sold.

Proceeds from the $5M raise will fund the commercialization of Causam’s cloud-based software product EnergyNetⓇ to enable a clean, digital, distributed, and secure power grid. Causam earns transaction fees by helping energy providers ($100B annual revenues in U.S.) improve profit margins, reduce working capital needs, aggregate distributed energy resources, and provide cleaner energy to their customers.

Investment Offering

- Convertible security

- $5M maximum raise

- $5K minimum investment per accredited investor

- $30M company valuation cap (discounted relative to a future Series A targeting a minimum $45 Million company valuation)

- Pursuant to SEC Rule 506(c) of Regulation D for private placement offerings

- Transferable and salable to other accredited investors after a one-year holding (restricted) period

Invest in Dollars or Ether. Causam designed a versatile tokenized security offering to make investing in a private company fast, easy, and secure by leveraging blockchain technology and its expertise in smart digital contracts.

Backed by 85 patents and an executive team with seven prior company exits, Causam uses big data analytics, deep experience in the telecom and fintech sector, as well as smart digital contracts to automate customer onboarding (supply from generators and demand from commercial end-users), power trading, auditing, payment, and real-time settlement with anyone on the electric grid using blockchain technology.

EnergyNetⓇ — Causam eXchange’s financial transaction technology

- Accelerates financial settlements from weeks or months to near real-time

- Eliminates expensive and inefficient brokers and burdensome financing costs

- Solves critical smart meter data challenges of measurement, verification, and settlement

- Facilitates unfettered energy choice and trading between any counterparties on the electric grid

- Enables distributed generation and storage to be compensated for valuable grid services

Causam’s initial product rollout is with retail electric providers by 2018 Q4 and green commercial building owners by 2019 Q1. Once EnergyNet is implemented for a customer, transactional revenues are slated to quickly scale with high profit margins. By 2020, Causam plans to expand EnergyNet beyond the distributed markets to address the $440B wholesale U.S. market.

To learn more and to start the investment process, visit: https://bite.causamexchange.com